Joint Meeting with the SD State Bar

Please join us on Friday, September 20th for this joint event with the State Bar of South Dakota.

A webinar of this event will not be offerd. It is in-person only.

Please note this event will be held at the MINNEHAHA Country Club.

Johnathan Blattmachr will present on three different topics:

The Magic of Grantor Trust. Grantor trusts are the backbone of many estate planning strategies from sales to trusts that are out of the owner's gross estate without causing gain recognition to building wealth for others without income tax. This presentation will go over the fundamentals and fine point of grantor trusts and how to make them work best for clients.

Flexible Beneficiary Trusts. A trust is the most powerful weapon a planner can hand clients. A grantor trusts typically is the number 1 choice. But once the grantor dies, the grantor trust status ends. In addition, there are several reasons not to use a grantor trust. The price paid for using a trust (which is not a grantor trust) is the high and immediately income tax bracket that the trust will face. This presentation will explain the ways trusts can be used while avoiding these high income tax brackets.

Self-Settled Trusts. Planners often face a dilemma: Getting assets out of a client's estate but not obtaining the income tax free step-up in basis upon the death of the former owners. This presentation will explain how to accomplish both either by attacking Rev Rul 2023-2 of through other means.

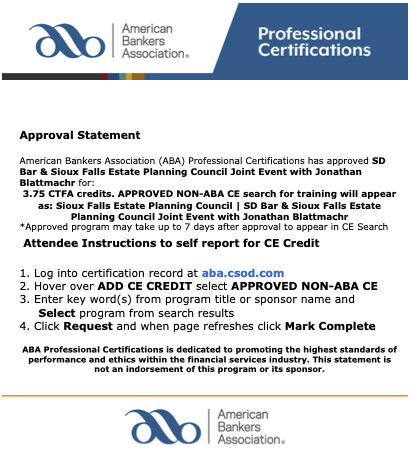

American Bankers Association (ABA) Professional Certifications has approved SD Bar & Sioux Falls Estate Planning Council Joint Event with Jonathan Blattmachr for:

3.75 CTFA credits. APPROVED NON-ABA CE search for training will appear as: Sioux Falls Estate Planning Council | SD Bar & Sioux Falls Estate Planning Council Joint Event with Jonathan Blattmachr

About the Speaker:

Jonathan G. Blattmachr is Director of Estate Planning for Peak Trust Company (formerly Alaska Trust Company) and a Director/Principal of Pioneer Wealth Partners, LLC in a boutique wealth advisory firm located in Chicago and New York. He is a Principal at Interactive Legal Services Management, LLC, serving as its Editor-in-Chief and Co-Author of its cornerstone products, Wealth Transfer Planning™ and Elder Law Planning™ and a retired member of Milbank (formerly Milbank Tweed Hadley & McCloy LLP) and of the New York, Alaska and in California bars. He is recognized as one of the most creative trusts and estates lawyers in the country and is listed in The Best Lawyers in America in. He graduated from Columbia University School of Law, cum laude, where he was recognized as a Harlan Fiske Stone Scholar. He has written and lectured extensively on estate and trust taxation and charitable giving and is author or co-author of nine books and more than 500 articles on estate planning and tax topics. Jonathan was on active duty in the US Army from 1970 to 1972, rising to the rank of Captain and was awarded the Army Commendation Medal. He is an instrument rated land and seaplane pilot and a licensed hunting and fishing guide in the Town of Southampton, New York.